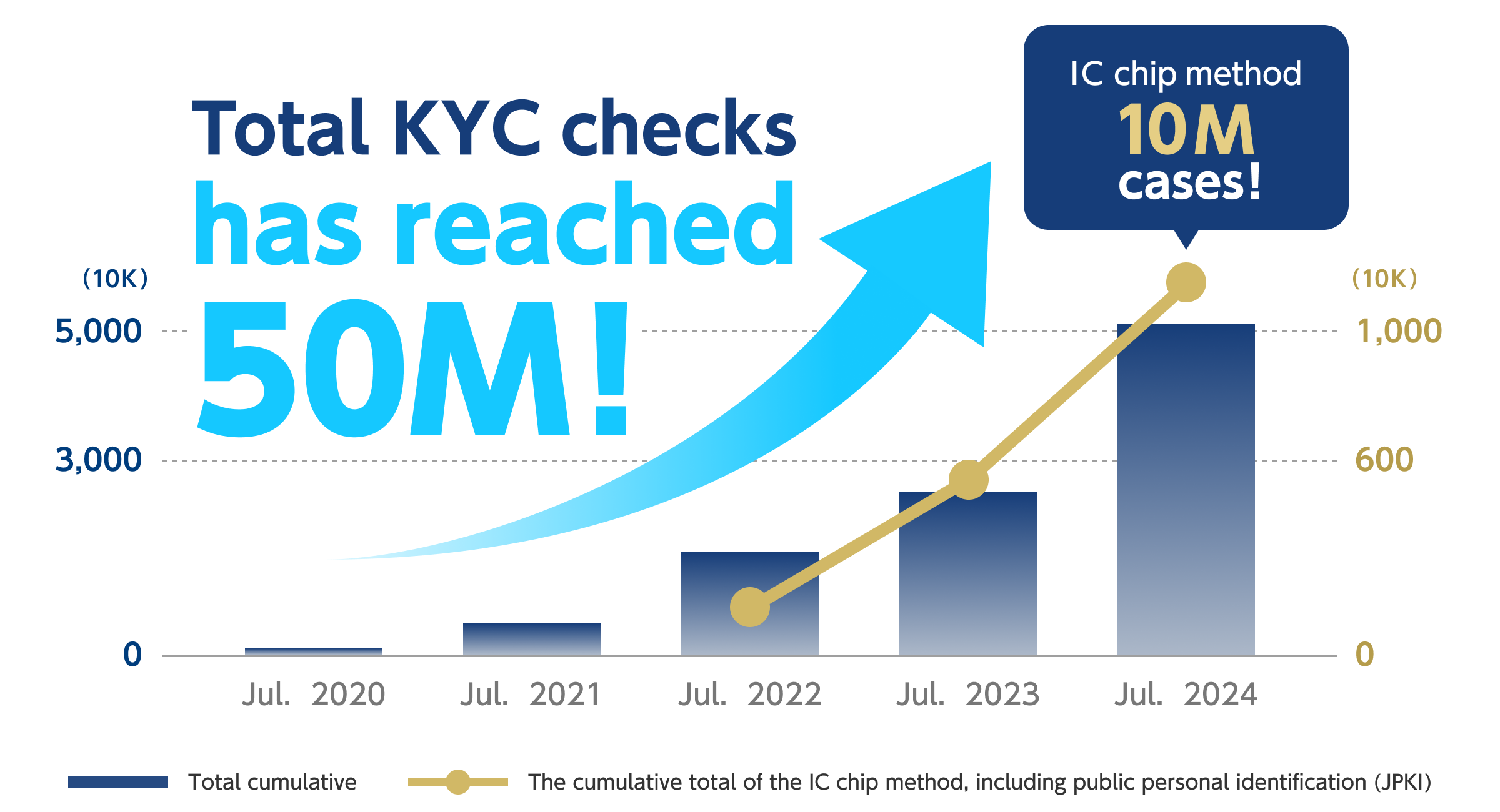

The fastest growth to date, with the IC chip method, including public personal identification (JPKI), steadily increasing to over 10 million

Liquid Inc., part of the ELEMENTS Group announces that on July 26th, the cumulative number of identity verifications for its online identity verification service “LIQUID eKYC” exceeded 50 million. This marks the fastest pace of a 10 million increase since the service was launched.

LIQUID eKYC” is a service that completes identity verification online by photographing identification documents or reading IC chips and matching them with self portraits, or by using public personal identification (JPKI). The service is characterized by a low withdrawal rate and low percentage of unclear images during the process, as well as high accuracy of automatic face recognition by using biometric and image processing technologies.

The industries where the system has been introduced include finance, mobile communication, second-hand shops, sharing economy-related services, matching applications, crypto asset trading services, and Web3-related services such as blockchain game guild services. In particular, the growing use of crypto asset trading services in opening accounts has been a contributing factor, with the monthly number of cases surpassing a record high of 2 million in March 2024. In addition, the number of cases of identity verification using IC chips, including public personal identification (JPKI), which the government has announced※1 to be mandatory for account opening and cell phone contracts, has been increasing steadily, exceeding 10 million cases. Against this backdrop, the cumulative number of identity verification cases has surpassed 50 million.

1 Crime Control Ministerial Conference, “Comprehensive Measures to Protect the Public from Fraud” (June 18, 2024).

https://www.kantei.go.jp/jp/singi/hanzai/kettei/240618/honbun.pdf

Some of the companies implementing our services

[FinTech] Paidy Inc. (PayPal Holdings, Inc.), pring Inc. (Google International LLC), Rakuten Wallet, Inc., RECRUIT MUFG BUSINESS Co., Ltd.

[Cryptocurrency exchange] Binance Japan, Inc., BitTrade Inc., bitFlyer, Inc., Coincheck, Inc.

[E-Scooter/Bike] Luup Inc., OpenStreet Co.

[Matching Technology] Omiai, Inc.

[Web3] SAKURA UNITED PLATFORM Pte.Ltd.

[Bank] JAPAN POST BANK Co., Ltd., SBI Sumishin Net Bank, Ltd., SBI Shinsei Bank, Limited, Seven Bank, Ltd.

[Credit Card Issuer] TOYOTA FINANCE CORPORATION, Credit Saison Co., Ltd., JCB Co., Ltd.

[Fashion eCommerce] ZOZO, Inc.

[Telecom] NTT DOCOMO, Inc., KDDI Corporation

Reference: Recent Trends of “LIQUID eKYC”

Achievement of 100% service uptime for three consecutive years

The system is available 24 hours a day, 365 days a year without service outages, including during system maintenance. In 2023, the service continued without interruption, achieving 100% uptime for the third consecutive year. This achievement is underpinned by a common cloud infrastructure provided to implementing businesses, allowing concentrated investment in security measures for enhanced security and performance. Additionally, we have continuously improved our development and operation processes based on ISMS and FISC safety standards to meet the strict security standards required by industries such as financial institutions and major telecommunication carriers.

Approximately 300 functional improvements and developments annually.

Based on dozens of KPIs (e.g., face identification rate) measured monthly, we are making functional improvements and developments for smoother identity verification for both users and businesses. Our focus is on finding the right balance between the high image quality demanded by businesses and the ease of photographing for users, as well as ensuring a user experience that prevents user drop-off. With a flexible development structure that allows for short release cycles, we quickly provide functions based on the needs of implementing businesses and business trends. In 2023, we accomplished approximately 300 functional improvements and developments. In addition to these improvements, we are also engaged in foundational enhancements in image recognition technology from R&D. This includes improving the ability to detect facial forgeries and enhancing the accuracy of AI-based quality judgment of captured images, using user data accumulated in a common infrastructure.

<Development related to public personal identification (JPKI)

1) Functions to reduce the man-hours required for identity verification using public personal identification (JPKI)

・Automated confirmation of the name of the person whose name is in kana, which used to require visual confirmation when setting up an account to receive money.

Automated verification of the name of the account holder’s name in Kana characters only against the registered name in Kanji characters only on the My Number Card.

https://liquidinc.asia/2023-10-31/

・”JPKI+ (personal number) “function for financial institutions, which enables simultaneous verification of identity and acquisition of personal numbers required for account opening.

https://liquidinc.asia/2024-03-26/

・A function that allows users to determine whether or not they have moved out of the country at the time of identity verification.

・A function to check whether a user is a foreign national based on the information on his/her My Number Card.

2) Various methods for public personal identification (JPKI) are provided.

・Public personal authentication application for businesses that require identity verification on a Web browser

https://liquidinc.asia/2023-12-19/

・Identity verification method compatible with smartphones equipped with my number card functions

https://liquidinc.asia/2023-04-26/

“LIQUID eKYC” with the largest share of the eKYC market for five consecutive years※

The service provides online completion of identity verification required for online contracts, account registration, and account opening. We offer a method that takes a picture of an identification document or reads an IC chip and matches it with selfies, as well as a method that utilizes public personal authentication (JPKI / Smartphone JPKI). We can also support age verification for student discounts. Our proprietary AI, biometric, and OCR technologies have enabled us to maintain a low drop-off rate from the start to the end of the photo shooting process and the cumulative number of identity verification cases has exceeded 50 million.

Web site: https://liquidinc.asia/global/kyc-application/

※ITR “ITR Market View: Identity Access Management / Personal Authentication Type Security Market 2024 eKYC Market: Sales Value Share by Vendor (FY2019-FY2023Forecast)

About Liquid

Liquid aims to create a seamless world where all of the world’s approximately 8 billion people can easily and safely use all services as they are by automatic and ubiquitous authentication. We provide our own Digital ID, KYC and Authentication service, where users can prove their identity anytime, anywhere in the world with their smartphone or face. We are expanding our service globally and use the know-how accumulated under the Japanese strict law and rule. We adapt our operations and services flexibly and quickly to changes in the required legal and security framework.

For more information, visit: https://liquidinc.asia/global/