In Japan, online identity verification, commonly known as “eKYC,” has rapidly gained attention in recent years. With the evolution of various digital technologies and the seamless flow of information in society, it can be described as an essential system infrastructure.

Especially crucial for understanding the use of eKYC in Japan is the Act on Prevention of Transfer of Criminal Proceeds, which functions as a regulation for anti-money laundering (AML) and counter-terrorism financing (CFT) measures.

Initially, this scheme started in the financial industry, but now it serves as a means to swiftly and accurately verify the identities of users across a wide range of industries.

Index

The Origins of eKYC in Japan

To break through this situation, the 2018 amendment to the regulations of the Act on Prevention of Transfer of Criminal Proceeds authorized the use of online electronic identity verification, known as “eKYC.” As a result, it has become possible to complete identity verification procedures online easily using a smartphone, for tasks such as opening bank accounts and issuing credit cards.

| Age | Impressive events | Enforcement of the Act |

|---|---|---|

| ~ 2018 |

|

|

| 2019 ~ 2020 |

|

|

| 2021 ~ 2022 |

|

|

| 2023 ~ |

|

|

“In this way, in Japan, the government is advancing detailed legislative measures, and efforts to prevent misconduct and crime and to combat anti-money laundering (AML) are being promoted not only in the strict compliance-focused financial industry but in various sectors.

For example, financial institutions and securities companies conduct identity verification for the purpose of preventing money laundering and other illegal activities in accordance with the Act on Prevention of Transfer of Criminal Proceeds. Additionally, it is evident that mobile phone companies and recycling businesses are also conducting identity verification in ways that suit their respective purposes.

| Target Institutions | Legal Basis | Objectives |

|---|---|---|

| Financial institutions, securities companies, etc. | Act on Prevention of Transfer of Criminal Proceeds | Prevention of money laundering, etc. |

| Mobile phone operators | Revised Act on Identity Confirmation, etc. Performed by Mobile Voice Communications Carriers for their Subscribers, etc. and Prevention of Wrongful Use of Mobile Voice Communications Services | Prevention of criminal use of mobile phones |

| Recycling businesses | Secondhand Goods Business Act | Prevention of the trade in stolen goods, etc. |

| Operators of matching apps | Act on Regulation on Soliciting Children by Using Opposite Sex Introducing Service on Internet | Prevention of use by minors and child protection |

Understanding the Structure of Identity Verification Systems

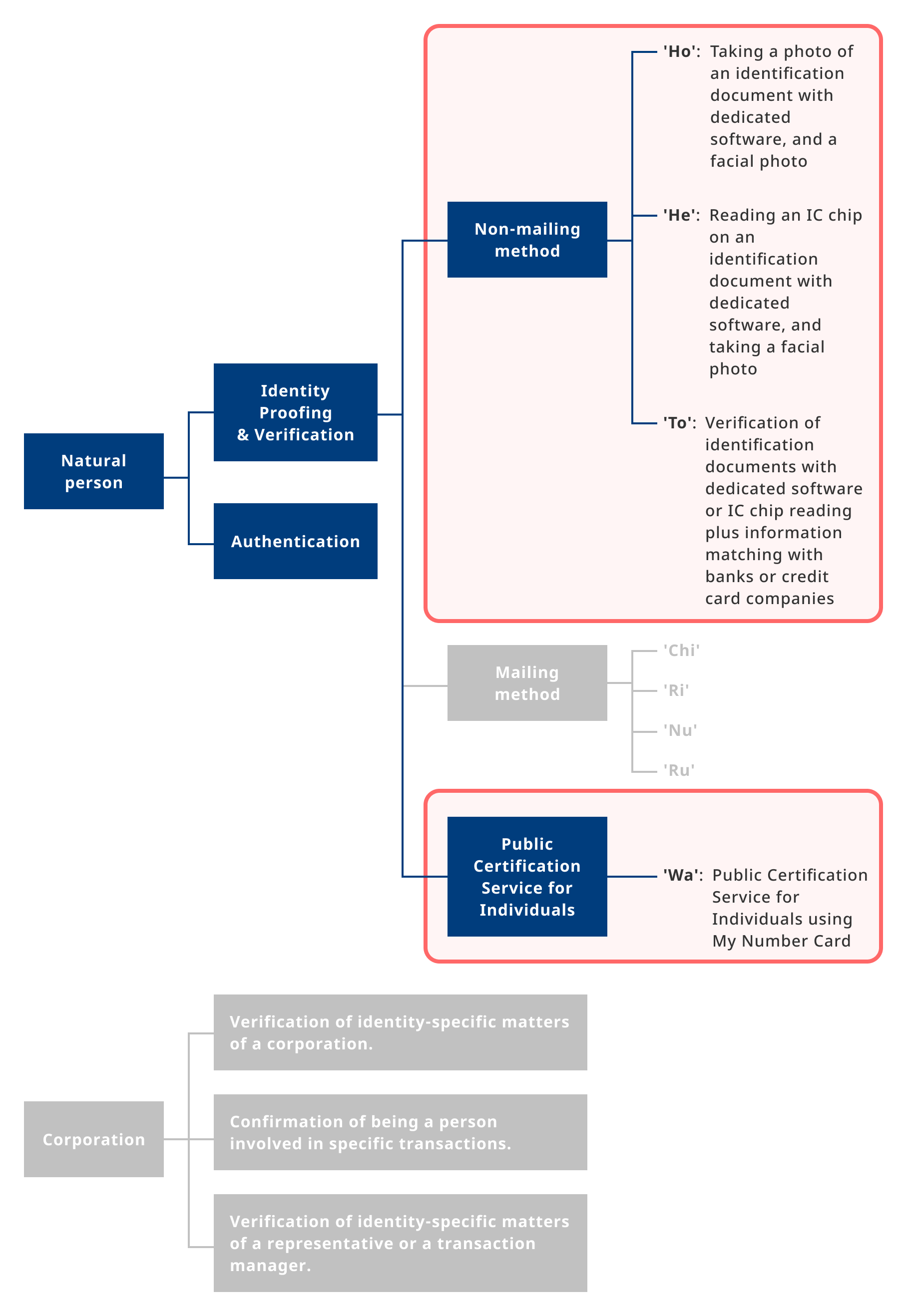

In the area of ID verification, it is broadly divided into ‘natural persons’ and ‘corporations’, with each having a tree-structured verification flow designated as ‘verification of natural persons’ and ‘corporate ID verification procedures’.

The identity verification circled in red in the diagram below refers to the process by which service providers confirm that users are indeed who they claim to be.

There are various methods of identity verification, but in light of the Act on Prevention of Transfer of Criminal Proceeds, they can be broadly categorized into three types: methods without postal mail, methods involving postal mail, and public personal authentication services. The symbols such as ‘Ho’ and ‘He’ represent the methods listed under Article 6, Paragraph 1, Item 1 of the Enforcement Regulations of the Act on Prevention of Transfer of Criminal Proceeds.”

About the Four Frequently Used Requirements of the Act on Prevention of Transfer of Criminal Proceeds

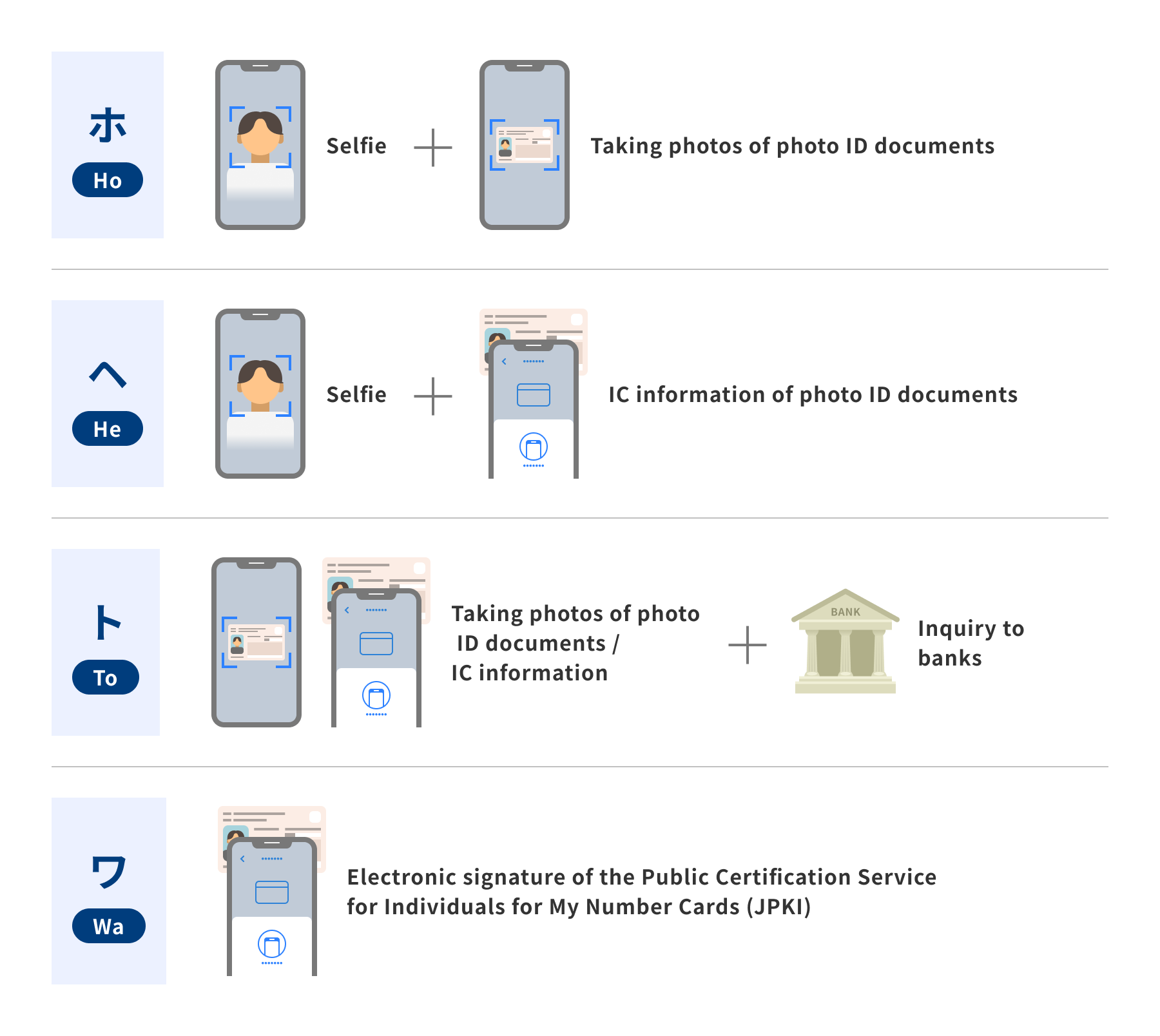

As previously mentioned, the 2018 amendment to the Act on Prevention of Transfer of Criminal Proceeds led to a stricter regime for verifying identities. Included in this amendment is the “definition of new processes in identity verification,” which made postal verification, once common, no longer mandatory. Additionally, new requirements for the verifier’s identity, such as the verification of appearance (using selfie photos), were added.

Within this context, we will introduce the four most frequently used requirements and their operational concepts.

| Japanese regulation title | Details |

|---|---|

| Article 6, Paragraph 1, Item 1, Ho of the Act on Prevention of Transfer of Criminal Proceeds | Transmission of images of “identification documents (including the backside and thickness)” and “the individual’s facial photograph. |

| Article 6, Paragraph 1, Item 1, He of the Act on Prevention of Transfer of Criminal Proceeds | Transmission of “IC chip information contained in photo ID documents” and “the individual’s facial photograph image. |

| Article 6, Paragraph 1, Item 1, To (1) of the Act on Prevention of Transfer of Criminal Proceeds | Transmission of “IC chip information contained in photo ID documents” and inquiries about customer information from the operator to financial institutions used by the customer. |

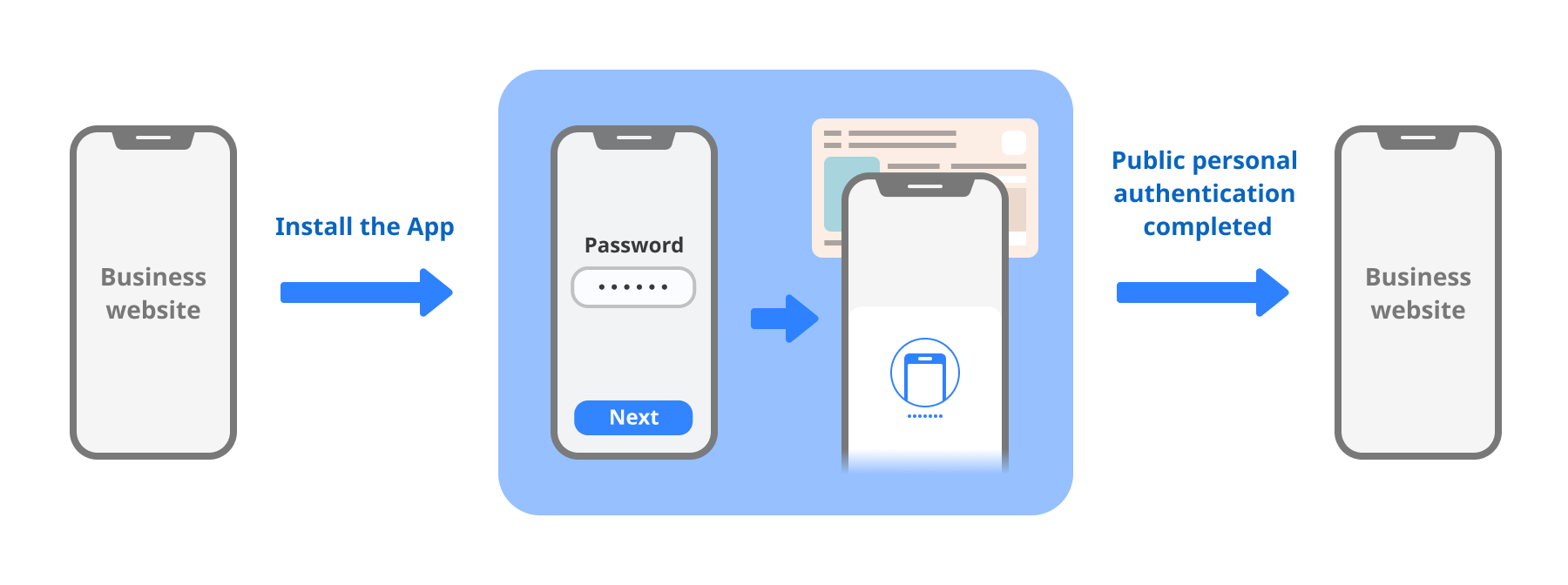

| Article 6, Paragraph 1, Item 1, Wa of the Act on Prevention of Transfer of Criminal Proceeds | Transmission of Public Certification Service for Individuals (electronic certification). |

Additionally, we will introduce the typical identity verification documents used in Japan. These documents comply with stringent regulations and are used not only to prove an individual’s identity but also in various aspects of life such as using financial services, real estate transactions, and international travel.

Notably, the My Number Card deserves special mention. In recent years, the number cof My Number Cards issued has surpassed that of driver’s licenses, and its usage as an identity verification document has rapidly increased (JPKI). Specifically, as of January 28, 2024, 99.32 million cards have been issued, which corresponds to approximately 79.2% of the population. The My Number Card is increasingly used not only as an identity verification document but also as a health insurance card at medical service points such as clinics.

Driver's License

Driving History Certificate

My Number Card

Individual Number Notification Card

Health Insurance Card

Residence Card

FAQ (8 Key Factors for Successful implementation of eKYC in compliance with Japanese regulations.)

Q

Do eKYC major overseas vendors comply with Japanese regulations?

A

They do not meet the regulations at all. Especially If you are a financial business and using a foreign vendor’s product, you may already be in violation of the regulation.

Q

May I fully automate the screening process?

A

If you do not provide the services described in the Regulations, then you can implement an automatic review. However, it is necessary to allow for the risk that fraud cannot be avoided.

Q

Is it acceptable to do Japanese identity verification screening overseas?

A

There seems to be no legal problem if the management tool provided from us is used. However, it would be more accurate to have a Japanese person do the screening, so it would be less risky to have our company handle the screening.

If you do not use the management tool we provide, you must obtain the consent of the individuals using the service to have their personal information cross borders (if the server is located outside of Japan). This is from the perspective of Japan’s Personal Information Protection Law.

Q

What is the Japanese Personal Information Protection Law?

A

Personal information in Japan is strictly protected by the government, which is similar to the GDPR in Europe. Identity verification in Japan is required to strictly adhere to the regulations for handling such personal information.

In addition, specified personal information such as personal numbers are not allowed to cross borders, and must be handled with the utmost care.

Q

Can a Japanese passport be used as a document for identification in Japan?

A

Passports issued after February 4, 2020 can no longer be used as identification documents. This is because the name, date of birth, and address must be verified in order to confirm identity, but this address is no longer included in the passport.

If the service you provide does not require verification of address, then a passport would also work.

Q

Are there any solutions that can detect various types of fraud?

A

There are solutions available to detect fraud with regard to the photo-taking method, but none of them are perfect.

If you want to reject fraud completely, there is the IC chip reading system in Japan.

This system reads the IC chip embedded in the ID card to verify the identity of the cardholder, and is tamper-resistant and highly resistant to unauthorized access.

Q

When considering identity verification using National card IC chip reading, what evaluation criteria should be used to select an eKYC system?

A

The following are recommended system evaluation axes

- Variety of identification methods

- User interface (usability)

- Availability of management screen for companies using the services

- Future expandability

- Price of the service

Q

Lots of legal requirements, not sure which ID to use and which method to implement.

A

Yes. The domestic regulations are very confusing.

We will propose a method for your business to comply with Japanese regulations. Even if you are not subject to the regulations, you can prevent fraudulent use by implementing a compliant method.

An Introduction to LIQUID eKYC

Finally, Liquid would like to introduce our company.

No.1 share in Japan's eKYC for five consecutive years

※Source: ITR “ITR Market View: Identity Access Management / Personal Authentication Type Security Market 2024 eKYC Market: Sales Value Share by Vendor (FY2019-FY2023Forecast)

Extensive experience in the financial sector.

In particular, exchanges such as Binance and Coinbase have been providing services to various companies.

Total KYC checks Over 40M cases

This product has been introduced across a variety of industries including finance, telecommunications carriers, second-hand shops, sharing economy-related services, dating apps, cryptocurrency trading services, and Web3-related services like blockchain game guild services.

Realization of 100% utilization rate

The system has achieved 100% uptime for three consecutive years through 24/7/365 operation with no service outage for users, including during system maintenance.

Approximately 300 functional improvements and developments per year

Liquid are improving and developing functions to make identification verification smoother for both users and businesses. Our features include an appropriate balance between the high image quality demanded by businesses and the ease of photographing for users, as well as a UX that prevents users from leaving the site.

High Security

Based on ISMS and FISC security standards, we support industries that require strict security standards, such as financial institutions and major telecommunications carriers. We have zero incidents of information leakage, and have earned the trust of our customers backed by our proven track record.

Why more than 200 companies in Japan have adopted LIQUID eKYC! Complete specs comparison.

| Item | General Market Issues | Our Response |

|---|---|---|

| Each card is supported | The cards make generic processing difficult, and accuracy is inconsistent due to the inability to accommodate language and camera quality. | Combines generic and individual processing to achieve highly accurate recognition with cards from compatible countries. |

| Downtime support | Due to the concentration of access during commercial broadcasts and campaigns, the service may be suspended and opportunities to acquire customers may be missed. | No downtime while processing 40 million applications in 4 years. Guaranteed stable service even during campaigns. |

| Service Improvements | Updates may not be provided after on-premise installation. | Cloud-based, guaranteeing continuous accuracy improvement and data drift handling. |

| New Device Support | There is a risk of slow adaptation to new devices and worse withdrawal rates; when the iPhone 14 pro was launched, there were also ekyc solutions that failed to respond to the major advances in device angle of view and became dysfunctional. | Rapid support for the latest devices, including immediate support for the iPhone 14 Pro and others. |

| Face Recognition Accuracy | There are engines that do not support Photo ID and Selfie comparisons. | Highly accurate authentication with Photo ID × Selfie is achieved by learning with production data. |

| Forgery Detection Accuracy | Forgery detection is nominal and withdrawal rates can be unreasonably high. | Combining an engine based on actual eKYC data with an external high-precision engine, we provide solutions to meet diverse needs. |

| Quality check | The withdrawal rate increases as people continue to refuse to be taken for unclear reasons. | Quality checks for blurring, reflections, position, etc. are performed based on actual data and the reasons are clearly explained to the user. |

| Platform Support | Native SDK only or web only may be supported. | Supports both Native SDK and Mobile Web for a wide range of devices. |

| Update Operation | Lack of updates can lead to inaccuracies or sudden updates can cause bugs. | One month’s notice of release and a stable release cycle of four years of operation provide customers with minimal maintenance and high transparency. |

Features

Images captured on smartphones are often coarse and difficult for image processing and AI-based recognition. However, Liquid’s proprietary image processing technology enables us to achieve low drop-off rates and low proportion of blurry images, as well as high accuracy in automatic facial recognition.

%

Drop-off rate in the lowest case

%

Percentage of unclear images

%

Facial recognition accuracy

※Face recognition of driver’s license photo and selfie photo. Automatic judgment OK: FAR 1/100,000 or less