— Image Recognition AI Minimizes User Abandonment and Supports Japan’s Legal My Number Acquisition —

Liquid Inc. , a member of the ELEMENTS Group, is pleased to announce that StoneX Group Inc., a company listed on the NASDAQ in the United States, has adopted Liquid’s online identity verification service, LIQUID eKYC. The solution will be implemented by its Japanese subsidiary, StoneX Securities Co., Ltd.

LIQUID eKYC will be used to verify customer identities during account openings for FOREX.com, the FX and CFD trading burand,m operated by StoneX Securities. Although StoneX Securities had previously utilized eKYC services, the company has now decided to transition to LIQUID eKYC, which is distinguished by its advanced image recognition AI technology, enabling more accurate identity verification.

With this transition, the company aims to prevent user drop-offs during the application process and anticipates that the number of account openings will approximately double as a result.

Background

FOREX.com is a global online trading platform that primarily offers foreign exchange (FX) trading and CFD trading services to individual investors and traders. The platform is used by over one million users across 180 countries worldwide.

In Japan, StoneX Securities has already implemented eKYC procedures for online account openings, which involve capturing images of identification documents and matching them with user selfies for identity verification. In order to achieve more accurate identification, StoneX Securities has decided to integrate “LIQUID eKYC”. .

Implementation Overview

LIQUID eKYC is an online identity verification solution that enables the completion of the entire verification process remotely through either the capture or IC chip reading of ID documents, combined with facial photo matching, or by utilizing Japanese Public Key Infrastructure (JPKI) for official digital authentication.

The solution is characterized by its use of biometric authentication and image recognition technologies, which contribute to reducing the drop-off rate during onboarding, minimizing the occurrence of unclear image submissions, and enhancing the accuracy of automated facial recognition. These features collectively improve the efficiency and reliability of the identity verification process.

Key Advantages of Implementing LIQUID eKYC

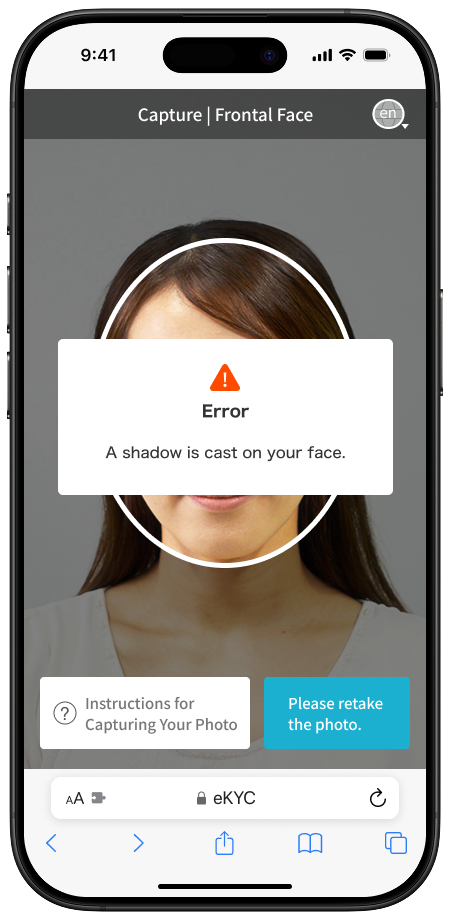

- Improved Completion Rates Through Real-Time, Contextual Error Messaging

Previously, many users abandoned the application process midway, particularly during the photo capture stage required for identity verification. With LIQUID eKYC, AI-powered image recognition provides real-time, detailed error messages during the capture process, guiding users more effectively.

Backed by over 130 million identity verifications across the group, the system leverages advanced technology and a meticulously designed user interface to ensure a seamless user experience. This allows users to proceed with confidence and minimal confusion, significantly improving the application completion rate.

Improving Approval Rates in the Post-Submission Review Process

LIQUID eKYC has a built-in review management function that enables clear identification of discrepancies—such as mismatches between information entered in the application form and the details on the submitted identification documents.

By integrating with LIQUID eKYC, the system can automatically notify users of specific errors and prompt them to reapply with corrected information. This reduces the need for individual follow-up with users.

In addition, tasks such as manual verification of ID documents, which are required under Japan’s Act on Prevention of Transfer of Criminal Proceeds, are handled through LIQUID eKYC’s BPO (Business Process Outsourcing) services.

This implementation not only enhances the efficiency of the overall review process but also contributes to a higher approval rate.

Compliance with Legal Requirements, Including MyNumber (Individual Number) Collection and Management

In Japan, financial institutions are required to conduct identity verification and collect MyNumber (Individual Number) information in accordance with the Act on Prevention of Transfer of Criminal Proceeds when opening accounts.

LIQUID eKYC not only supports legally compliant identity verification, but also offers end-to-end support for the collection, management, and secure storage of MyNumber data. This is particularly advantageous for foreign-affiliated companies, for whom MyNumber compliance often poses a significant operational challenge.

By accommodating Japan’s complex and use-case-dependent regulatory requirements, LIQUID eKYC helps ensure full legal compliance while streamlining onboarding operations.

Proven Track Record in Identity Verification for Foreign Nationals

LIQUID eKYC has a strong track record of verifying the identities of a wide range of users, both in Japan and internationally. At FOREX.com, identity verification is conducted not only for Japanese nationals residing in Japan but also for foreign residents.

This capability ensures that the onboarding process is inclusive, compliant, and effective across diverse user segments.

Dedicated Support Team for Foreign-Affiliated Companies

LIQUID eKYC offers a specialized support team dedicated to foreign-affiliated enterprises. This team provides comprehensive implementation and operational support entirely in English, including guidance on navigating regulatory compliance requirements in Japan.

This structure ensures a smooth and reliable onboarding experience for global companies entering or operating in the Japanese market.

About FOREX.com

FOREX.com is a global online trading platform operated by StoneX Group Inc., a company listed on the NASDAQ (Ticker: SNEX). The platform serves customers in over 180 countries and offers access to more than 12,000 financial instruments worldwide.

In Japan, FOREX.com provides trading services for 84 FX currency pairs and 26 Knock-Out Option products. Trading is available via PC (web platform) and mobile devices (iPhone and Android), and the platform also supports MetaTrader 4 (MT4).

Website: https://www.forex.com/jp/

About LIQUID eKYC: No.1 Market Share for Six Consecutive Years※

The service provides online completion of identity verification required for online contracts, account registration, and account opening. We offer a method that takes a picture of an identification document or reads an IC chip and matches it with selfies, as well as a method that utilizes public personal authentication (JPKI / Smartphone JPKI). We can also support age verification for student discounts. Our proprietary AI, biometric, and OCR technologies have enabled us to maintain a low drop-off rate from the start to the end of the photo shooting process. As a result, the ELEMENTS Group has achieved a cumulative total of approximately 130 million identity verifications, with around 600 companies having adopted our services.

Web site: https://liquidinc.asia/global/kyc-application/

※ITR “ITR Market View: Identity Access Management / Personal Authentication Type Security Market 2025 eKYC Market: Sales Value Share by Vendor (FY2019-FY2024Forecast)

About Liquid Inc.

Liquid aims to create a seamless world where all of the world’s approximately 8 billion people can easily and safely use all services as they are, by automatic and ubiquitous authentication. We provide our own Digital ID, KYC, and Authentication service, where users can prove their identity anytime, anywhere in the world with their smartphone or face. We are expanding our service globally and use the know-how accumulated under the strict Japanese laws and rules. We adapt our operations and services flexibly and quickly to changes in the required legal and security framework.

For more information, visit: https://liquidinc.asia/global/