Compliant eKYC in Asia

LIQUID eKYC service offers a seamless and efficient way to authenticate customer identities, ensuring compliance with regulatory frameworks across the region. By leveraging advanced technologies, we verify customers’ identification documents and personal information with speed and accuracy, bolstering security and privacy protection.

Countries

Philippines

eKYC in Philippines

When performing identity verification in the Philippines, it’s possible to take photos of identity verification documents, capture and log identity information (including biometric data) using information and communication technology, and manually input identity details.

Documents

Driver's Licence

Phill ID

Residence Card

SSS1

SSS2

Passport

Required for eKYC

The Anti-Money Laundering Council (AMLC) establishes guidelines for financial institutions regarding the Identity Verification Process. Specifically, for conducting eKYC in the Philippines, the AMLC sanctions the use of Information and Communication Technologies (ICT) as an effective method to execute the Identity Verification Process.

Identification information:

- full name

- date of birth

- place of birth

- sex

- address

- contact number / information

- country of citizenship

- signature or biometric information

Identity verification documents

- Driver’s license

- PhilID

- SSS ID

- UMID

- TIN ID

- Passport

Indonesia

eKYC in Indonesia

Bank Indonesia has announced regulations regarding the prevention and countermeasures of money laundering and terrorism financing. These regulations establish frameworks for customer identification, verification, and record management. They apply to all financial institutions operating in Indonesia and require a risk-based approach to customer identification and verification.

ID Documents

Driver's License 1

Driver's License 2

National ID

Passport

Required for eKYC

For identity verification, it is necessary to obtain the following identity verification information and certain documents (except for low-risk customers).

Identification information:

- Full Name

- Identity document number

- Residential address according to identity documents

- Place and date of birth

- Biometric data or signatures

Identity verification documents

- Kartu Tanda Penduduk (KTP)

- Kartu Identitas Anak (KIA)

- Driver’s License

- BPJS Kesehatan

- KITAP

- Passport

Guidelines of Bank Indonesia

When implementing eKYC solutions, businesses are obligated to report their usage to Bank Indonesia and ensure the implementation of strong identity verification methods or technologies. It is crucial to establish effective policies and risk control procedures to comply with regulatory requirements.

According to the guidelines provided by Bank Indonesia, businesses are obligated to collect identity information from official government-issued documents such as the Identity Card (KTP), driver’s license (SIM), passport, or other authorized identification documents.

Vietnam

eKYC in Vietnam

The regulations for electronic Know Your Customer (eKYC) in Vietnam are governed by the State Bank of Vietnam (SBV) and the Ministry of Public Security (MPS). Key regulations regarding eKYC in Vietnam include decrees that establish the legal framework for eKYC and circulars that provide detailed guidelines for eKYC in the banking sector.

Under these regulations, all financial institutions, including FinTech companies, are required to perform eKYC during the onboarding process for new customers. The eKYC process is utilized for customer identity verification, personal information collection, and assessment of risk levels.

Companies are obligated to collect and verify the identity information of new customers, matching it with relevant identification documents, either before or during the onboarding process.

ID Documents

Driver's License

Citizen ID (CCCD)

Passport

Required for eKYC

Identification information:

- Full name

- Date of birth

- Nationality

- Profession & position

- Phone number

- ID number, date & place of issue

- Registered permanent residence address

Identity verification documents

- Citizen ID card (CCCD)

- National ID card (CMND)

- Passport

- Other documents issued by authorities

Guidelines of the State Bank of Vietnam (SBV) and the Ministry of Public Security (MPS)

The regulations for electronic Know Your Customer (eKYC) in Vietnam are governed by the State Bank of Vietnam (SBV) and the Ministry of Public Security (MPS), who have established detailed guidelines for eKYC. The technical requirements for the eKYC process involve using secure and reliable technologies that ensure the integrity and confidentiality of collected information. Biometric authentication methods such as fingerprint, facial recognition, and voice recognition are also recommended.

Furthermore, a new law on anti-money laundering will be implemented starting from March 2023, expanding the list of reporting entities required to implement KYC measures for verifying customer identities.

On April 17, 2023, the government announced the Personal Data Protection Decree (PDPD) concerning the protection of personal information. It came into effect on July 1, 2023, impacting all organizations and individuals handling the personal information of Vietnamese individuals, regardless of whether they are located domestically or abroad, within the electronic and internet environment.

Singapore

eKYC in Singapore

The adoption of eKYC in Singapore has witnessed significant growth, especially within the financial services sector, where it facilitates account openings, loan applications, and various financial transactions. With its inherent convenience and robustness, eKYC has emerged as a preferred method for identity verification, eliminating the reliance on physical documents and in-person verification. This streamlined process ensures a heightened level of security and accuracy, greatly enhancing the user experience.

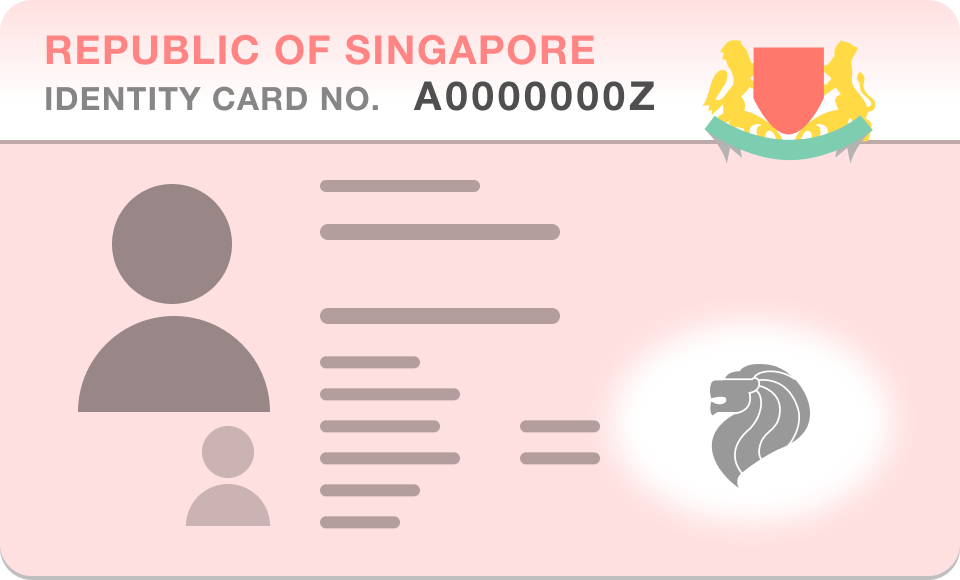

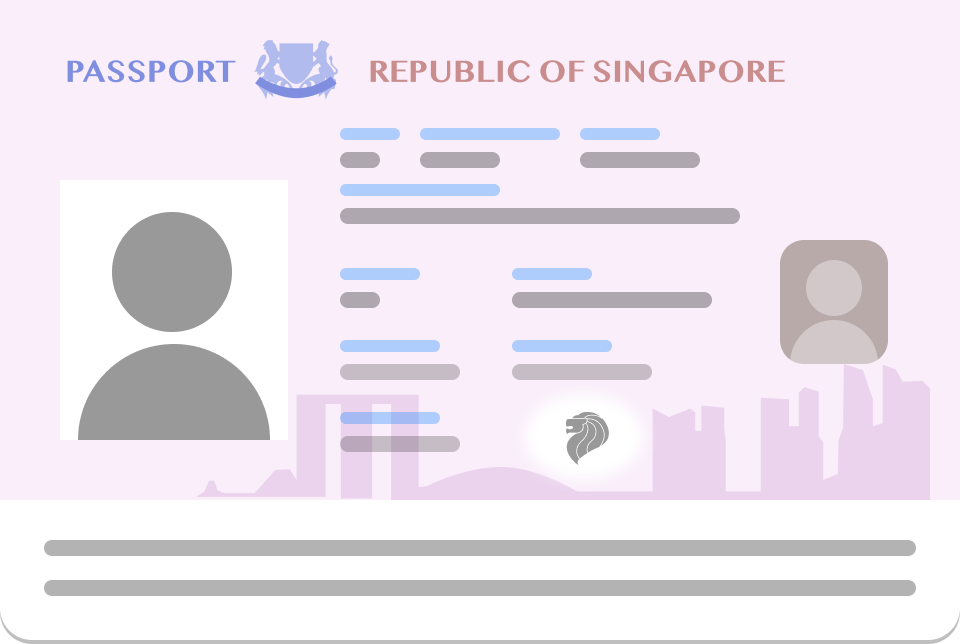

ID Documents

Driver's License

National ID

Passport

Required for eKYC

For identity verification, it is necessary to obtain the following identity verification information and certain documents (except for low-risk customers).

Identification information:

- full name, including any aliases;

- unique identification number (such as an identity card number, birth certificate number or passport number)

- residential address

- date of birth

- nationality

Identity verification documents

- Driver’s License

- National ID

- Passport

Guidelines of Monetary Authority of Singapore (MAS)

The Monetary Authority of Singapore (MAS) has issued guidelines outlining the process for financial institutions to conduct identity verification. Specifically, they are required to verify customers using reliable, independent sources of data, documents, or information. Moreover, companies can verify customers who are residents of Singapore by leveraging SingPass, a trusted digital ID in Singapore, which is considered a reliable independent source of information for customer onboarding purposes.

Thailand

eKYC in Thailand

The guidelines and procedures for eKYC are regulated by the Bank of Thailand (BoT), governing the rights and obligations of corporate and natural persons in preventing and detecting money laundering and terrorist financing. Companies must adhere to identity verification guidelines according to the Identity Assurance Level (IAL).

In 2015, the government formulated “Thailand 4.0,” a long-term vision for the country’s economic and social development, which included establishing a digital government framework. As part of this effort, the Digital ID Act was enacted in 2019 to enhance security in online transactions and facilitate digital commerce. It serves as the legal foundation for the development of technology platforms that identify and authenticate the digital IDs of Thai citizens. On June 1, 2022, the Personal Data Protection Act (PDPA) was fully implemented in Thailand, focusing on safeguarding personal information.

ID Documents

Driver's License

National ID

Passport

Required for eKYC

Identity verification documents

- Driver’s License

- National ID

- Passport

In Thailand, each citizen is issued a national ID card called “Bat Prachachon”. Remarkably, this ID card is provided to individuals starting from the age of 7 and carries an obligation to carry it at all times.

Identification methods:

National ID

- As evidence of customer identification, the image of the Thai National ID is captured.

- The status of the National ID is verified ultimately with the Department of Provincial Administration (DOPA)

- Biometric matching is performed.

-

Full name

-

Date of birth

-

Date of issue

-

Code

-

Passport

-

The passport chip is accessed using NFC technology.

-

The passport’s status is checked ICAO (International Civil Aviation Organization) guidelines.

-

Biometric comparison is conducted.

Guidelines of the Bank of Thailand (BoT)

Guidelines and procedures for eKYC are managed by The Bank of Thailand (BoT). The guidelines pertain to the rights and obligations of corporate and natural persons in preventing and detecting money laundering and terrorist financing.Companies are required to adhere to identity verification guidelines based on their Identity Assurance Level (IAL). There are primarily two methods used for customer identity verification.

Companies must ensure strict compliance with the Personal Data Protection Act (PDPA) regulations, which consist of rigorous guidelines for the collection and storage of customer information. They must verify that user data is securely stored, encrypted, and measures are in place to prevent unauthorized access.

Malaysia

eKYC in Malaysia

The Central Bank of Malaysia (BNM) has announced regulations regarding electronic Know Your Customer (eKYC) procedures. These regulations enable financial institutions to digitally verify customer identities without the need for physical documents. The eKYC policy document outlines the principles and requirements that financial institutions must adhere to when implementing the eKYC process.

Key requirements include ensuring the eKYC process is secure, reliable, and accurate, as well as complying with legal and regulatory requirements related to customer due diligence. Financial institutions are also required to implement appropriate risk management controls and ensure the privacy and confidentiality of customer information.

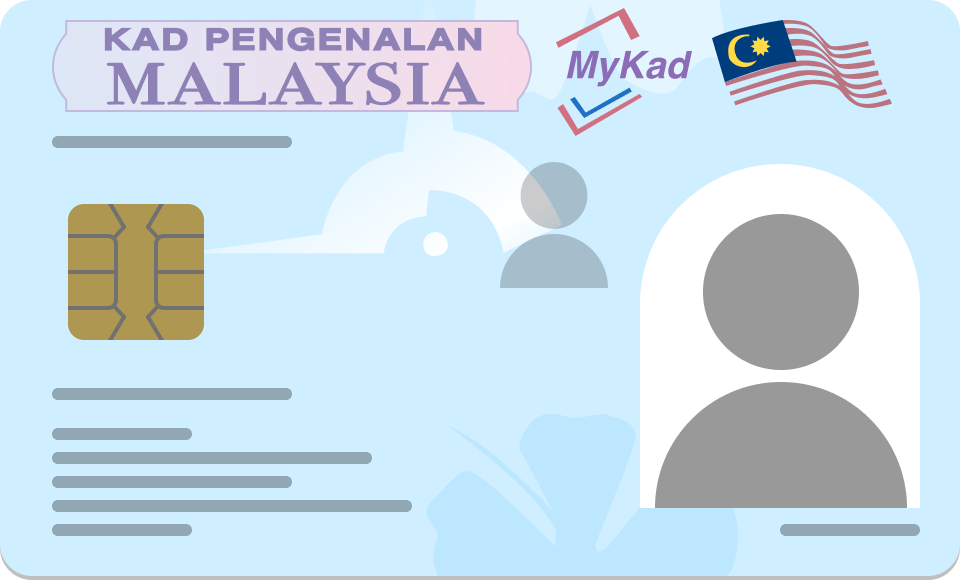

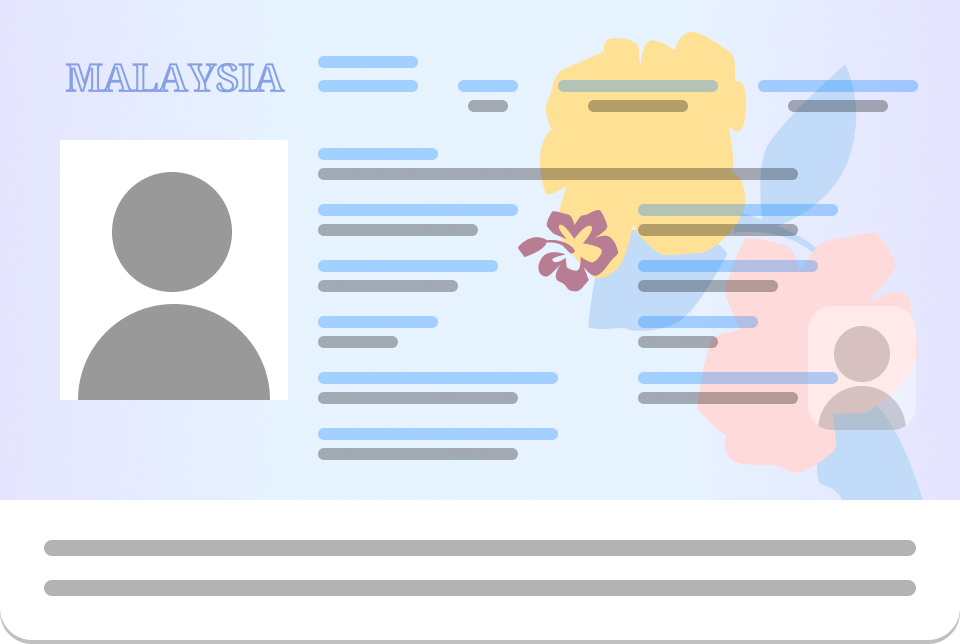

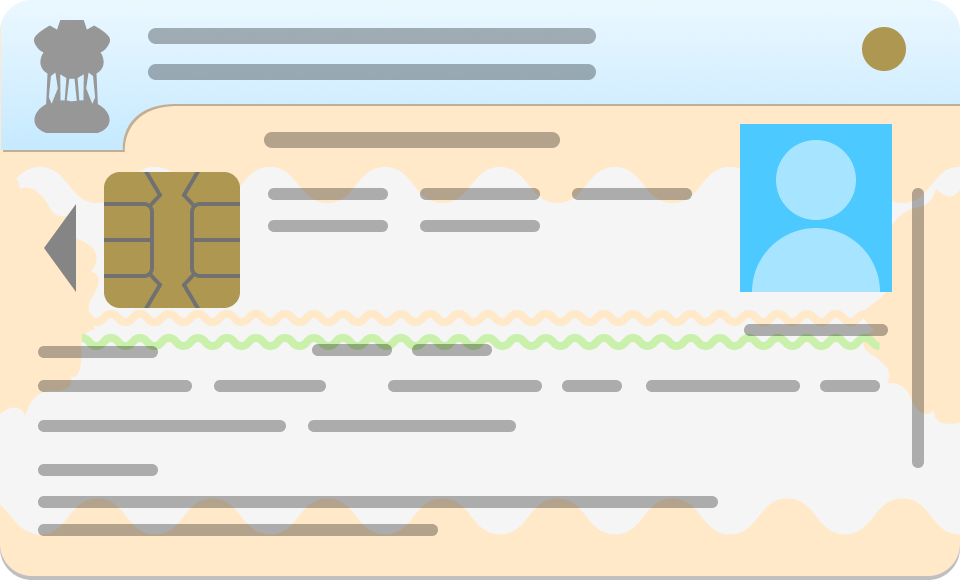

ID Documents

Driver's Licence

National ID (MyKAD)

Passport

Required for eKYC

Identity verification documents

- MyKAD

- Passport

- Other official Identity Documents

The Central Bank of Malaysia (BNM) categorizes the types of eKYC checks into three categories based on the identity verification documents.

The IC chip in MyKad contains essential identification details:

- Name

- Address

- Gender

- Facial photograph

- Fingerprints

- Religious affiliation (for Muslims)

- State of birth

Guidelines of the Bank Negara Malaysia (BNM)

The Central Bank of Malaysia (BNM) has established electronic Know Your Customer (eKYC) procedures. These regulations enable financial institutions to digitally verify customer identities without the need for physical documents. The eKYC policy document outlines the principles and requirements that financial institutions must adhere to when implementing the eKYC process.

A key metric that BNM must manage when using eKYC solutions is the False Acceptance Rate (FAR), which must be below 5%. BNM categorizes the types of eKYC checks into three categories based on the identity verification documents

India

eKYC in India

The government has been actively promoting digitalization across various sectors, with a particular focus on digital transformation in finance. This effort aims to improve citizen welfare and enhance the efficiency of economic activities. To achieve this, the central government has developed a diverse range of functionalities based on the Aadhaar system, a unique identification number, and opened it up to both public and private entities as a digital infrastructure.

By utilizing the Aadhaar-based personal information inquiry system (Aadhaar eKYC), financial institutions have significantly reduced the costs associated with KYC (Know Your Customer) requirements during the opening of new accounts. Moreover, fintech startups have integrated Aadhaar eKYC and other services into their offerings, allowing for online completion of procedures and transactions.

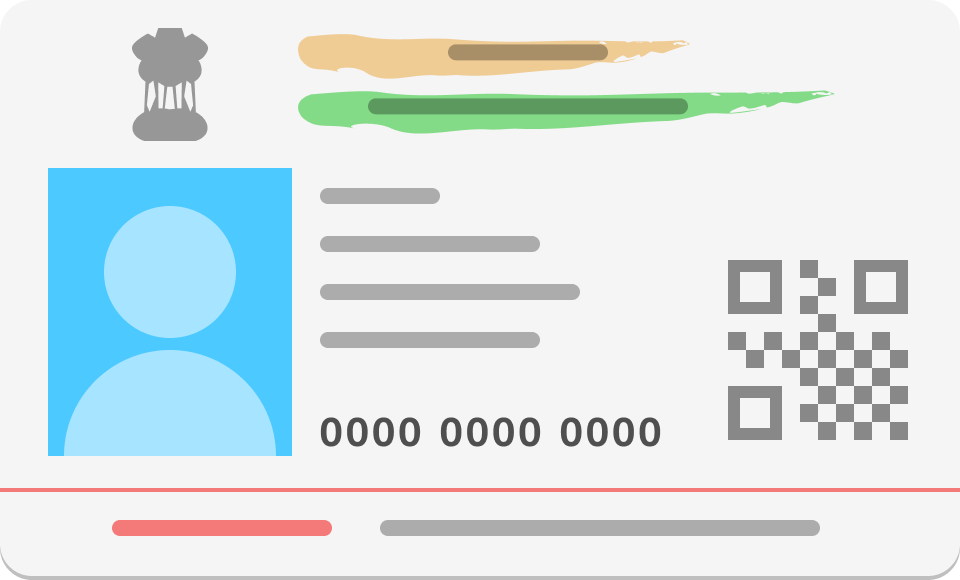

ID Documents

Driver's Licence

National ID (Aadhaar)

Passport

Required for eKYC

Identity verification documents

- Aadhaar

- Passport

The Aadhaar contains essential identification details:

- Name

- Gender

- Address

- Date of birth

- Facial photograph

※Aadhaar: approximately 1.23 billion people, which accounted for 92.2% of the total population of 1.33 billion, were registered as of 2018.

Guidelines of the Reserve Bank of India (RBI)

Based on the “Know Your Customer” (KYC) guidelines issued by the Reserve Bank of India (RBI), banks are required to conduct due diligence before engaging in any banking transactions. Bank customers are obligated to periodically update their KYC details. Banks may request customers to undergo re-KYC in order to keep their records up to date. The Reserve Bank of India (RBI) has simplified the process of periodic KYC updates.

Please feel free to contact us at anytime

for further information or assistance.

Products

LIQUID eKYC

KYC Application

Liquid provides a comprehensive solution for identity verification that combines document and appearance capture with the highest level of accuracy and judgment.

LIQUID eKYC

AI verification dashboard

Liquid provides an AI verification function that automates identity verification operations and a screening dashboard that allows users to access AI screening-based results for reference.