Leading companies merge to strengthen measures against cybercrime and financial crime, leveraging a track record of 120 million identity verifications

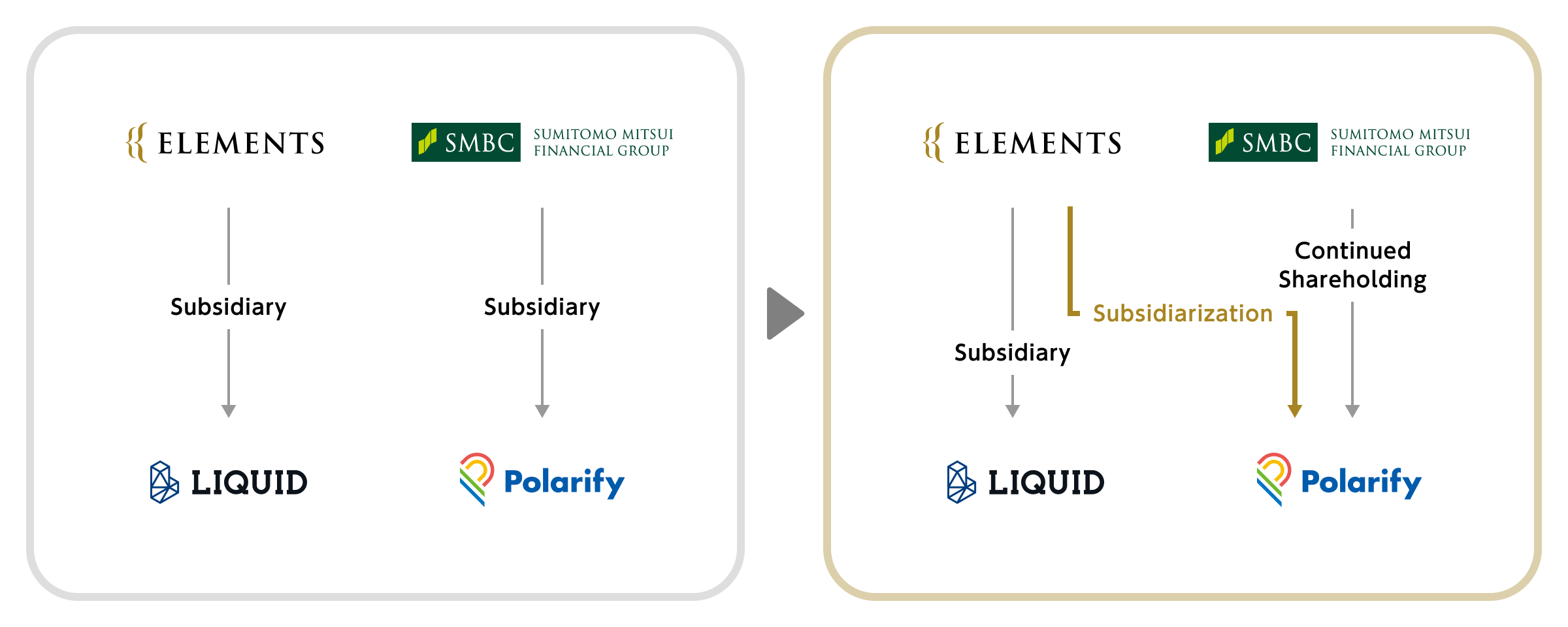

ELEMENTS, Inc. (Headquarters: Chuo-ku, Tokyo; President and CEO: Hiroki Hasegawa; hereinafter “ELEMENTS”), which develops biometric authentication and image recognition services, announced that its Board of Directors, at a meeting held on January 14, 2025, resolved to acquire shares of Polarify, Inc. (Headquarters: Minato-ku, Tokyo; CEO: Tomohiro Wada; hereinafter “Polarify”), a subsidiary of Sumitomo Mitsui Financial Group, Inc. (Headquarters: Chiyoda-ku, Tokyo; Group CEO: Toru Nakashima; hereinafter “SMBC Group”) to make it a consolidated subsidiary. The SMBC Group will remain as a shareholder of Polarify.

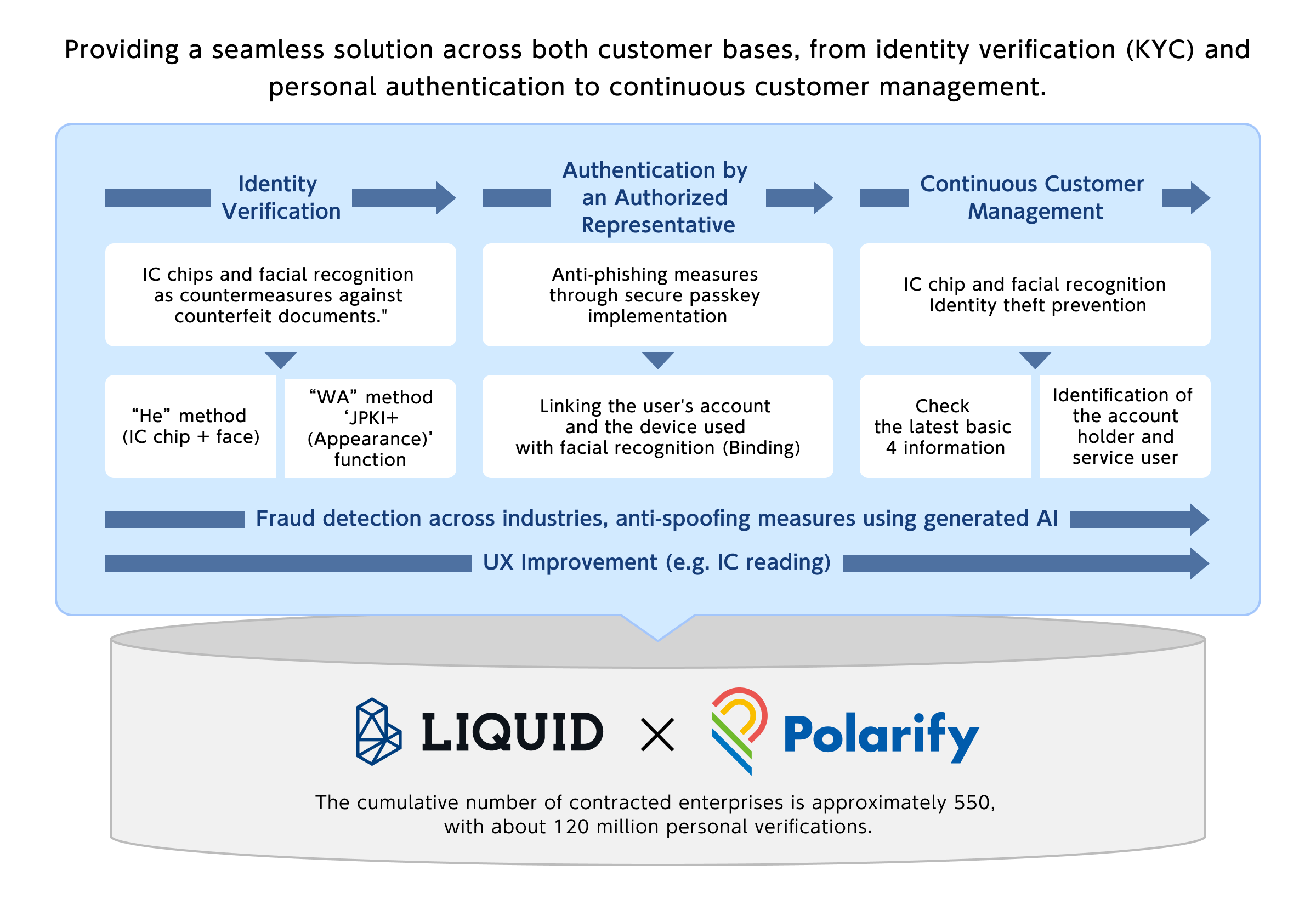

This integration of leading companies will expand the customer base, with the accumulated contracts reaching approximately 550 companies and identity verifications totaling around 120 million. As a result, Liquid, Inc. (Headquarters: Chuo-ku, Tokyo; Representative Director: Hiroki Hasegawa; hereinafter “Liquid”), a wholly owned subsidiary of ELEMENTS that provides online identity verification services, has partnered with Polarify to provide a wider range of customers with solutions for the mandatory use of personal identification through the use of the IC chips in My Number cards and driver’s licenses chips, as well as providing Liquid’s own solutions, we will strengthen our measures against cybercrimes such as social media-based investment fraud, romance scam, illicit part-time job schemes, deepfakes, as well as financial crimes such as unauthorized account use and money laundering.

Through this capital and business alliance, Liquid and Polarify will combine their achievement, , know-how and solution development capabilities in the online identity verification business to provide comprehensive authentication solutions for their customers . At the same time, ELEMENTS Group and SMBC Group will strengthen their commitment to the online identity verification business in Japan, where high growth is expected, and will take on the challenge of business developmentin overseas.

As part of its acquisition of Polarify, ELEMENTS has signed a strategic long-term partnership with Daon, a global leader in identity assurance technology, building on Daon’s role as Polarify’s identity technology provider. This collaboration will ensure a seamless transition for existing Polarify customers and creates new opportunities for ELEMENTS working with Daon to address evolving identity security challenges and enhance customer identity experiences including Fast Identity Online (FIDO) authentication. This collaboration ensures ELEMENTS has access to the Daon technology platform IdentityX which was used by Polarify customers and includes the opportunity to leverage the Daon TrustX platform for future business.

Background

In recent years, the acceleration of digitization has made the use of online services increasingly accessible. However, this has also led to a rise in online fraud and identity theft. As a countermeasure, identity verification has proven effective, and with the revision of the Act on Prevention of Transfer of Criminal Proceeds in November 2018, a system called eKYC (electronic Know Your Customer), which verifies customers’ identities online, has become widespread across various industries.

【About ELEMENTS and Liquid】ELEMENTS was established in 2013 and aims to solve social issues through technologies such as biometric authentication, image recognition, and generative AI. The company’s main business at present is “LIQUID eKYC,” a service provided by Liquid from 2019 that allows customers to complete identity verification required for account registration and account opening online. It offers a system that takes a photo of the user’s ID document, such as a driver’s license or My Number card, or reads the IC chip, and then compares it with the user’s selfie photo, as well as a system that uses the public certification for Individuals (JPKI / smartphone JPKI).

【About Polarify】Polarify, a consolidated subsidiary of the SMBC Group established in 2017, was the first company to be approved by the Financial Services Agency that is advancing the banking industry. Its main business is the “Polarify eKYC” service, which enables online identity verification, similar to the “LIQUID eKYC” service that has been offered since 2018.

【Both services have been adopted by many industry-leading businesses】As a result of the business integration, the customer base will be expanded, with the total number of subscribing companies reaching approximately 550 and the total number of identity verifications totaling around 120 million. Both services have been widely adopted by industry-leading businesses, particularly in industries where identity verification is required under the Act on Prevention of Transfer of Criminal Proceeds and the Mobile Phone Improper Use Prevention Act.

( Contracted businesses for “LIQUID eKYC” and “Polarify eKYC” (partial) )

※Source: Data from the websites of both companies. Liquid installation results. Polarify installation results.

Future initiatives for both parties

1. Promotion of identity verification using IC chips in line with government policy, and strengthening fraud countermeasures

Alignment with the policy outlined in the “Comprehensive Measures to Protect Citizens from Fraud*1” of the Ministerial Meeting Concerning Measures Against Crime, we will provide Liquid’s unique fraud countermeasures solution to users of both Liquid and Polarify, in addition to providing the “He”*2 and “Wa” (JPKI)*3methods will be promoted. Additionally, Liquid’s proprietary fraud prevention measures will be deployed across the both customers.

※1 The Ministerial Meeting Concerning Measures Against Crime “Comprehensive Measures for Protecting Citizens from Fraud” (June 18, 2024)

※2 Method He: This method involves receiving the user’s facial image and IC chip information from a photo ID to perform identity verification(in compliance with Article 6, Paragraph 1, Item 1 of the Enforcement Regulations of the Act on Prevention of Transfer of Criminal Proceeds and Article 3, Paragraph 1(Ni)of the Enforcement Regulations of the Act on Prevention of Unauthorized Use of Mobile Phones)

※3 Method Wa: This method uses the IC chip information from the user’s My Number Card and the public personal authentication service provided by the Local Public Organization Information System Organization to perform identity verification (in compliance with Article 6, Paragraph 1, Item 1 of the Enforcement Regulations of the Act on Prevention of Transfer of Criminal Proceeds and Article 3, Paragraph 1(Wa)of the Enforcement Regulations of the Act on Prevention of Unauthorized Use of Mobile Phones)

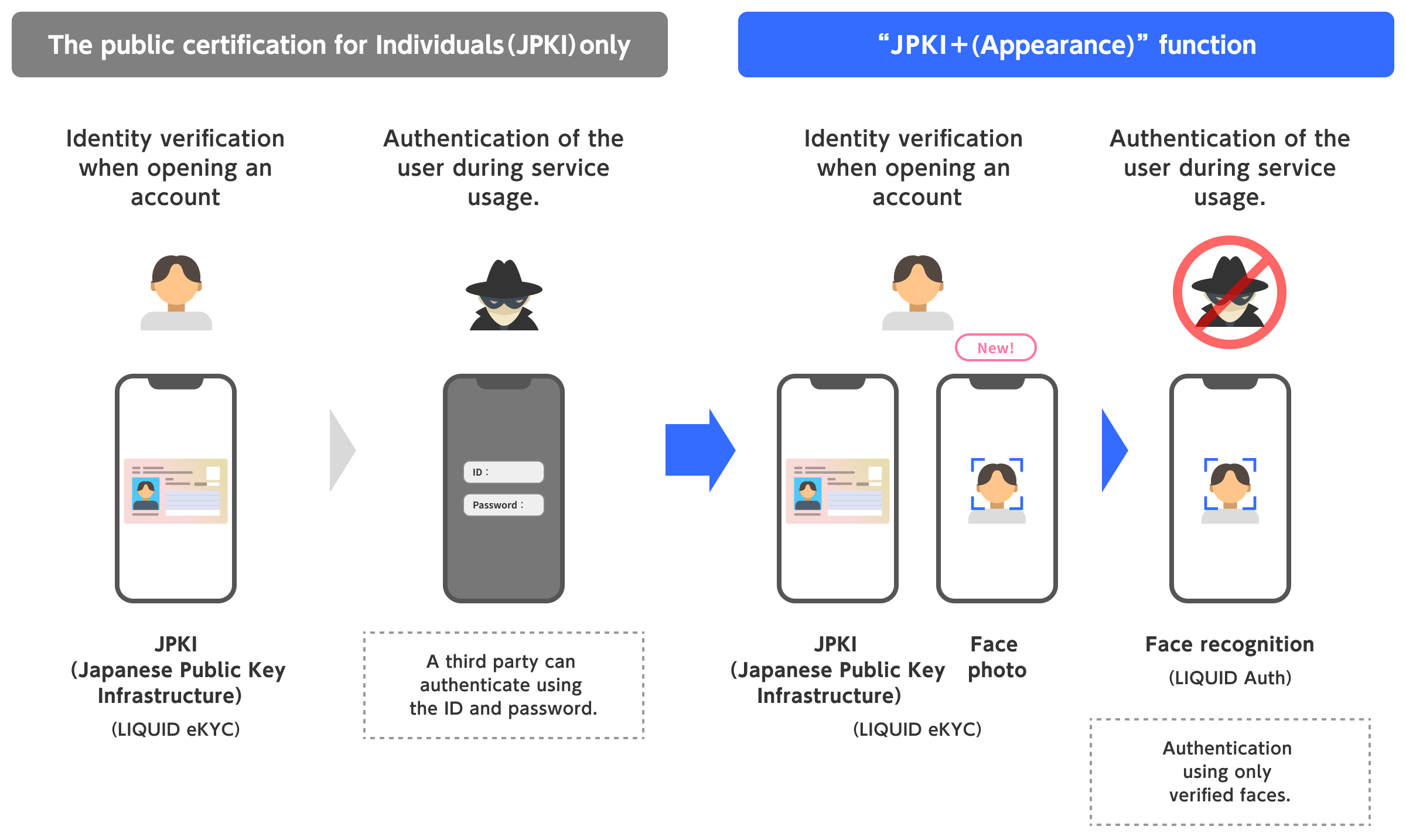

・Anti-spoofing measures using the “JPKI+ (facial appearance)” function for device binding (linking accounts to smartphones)

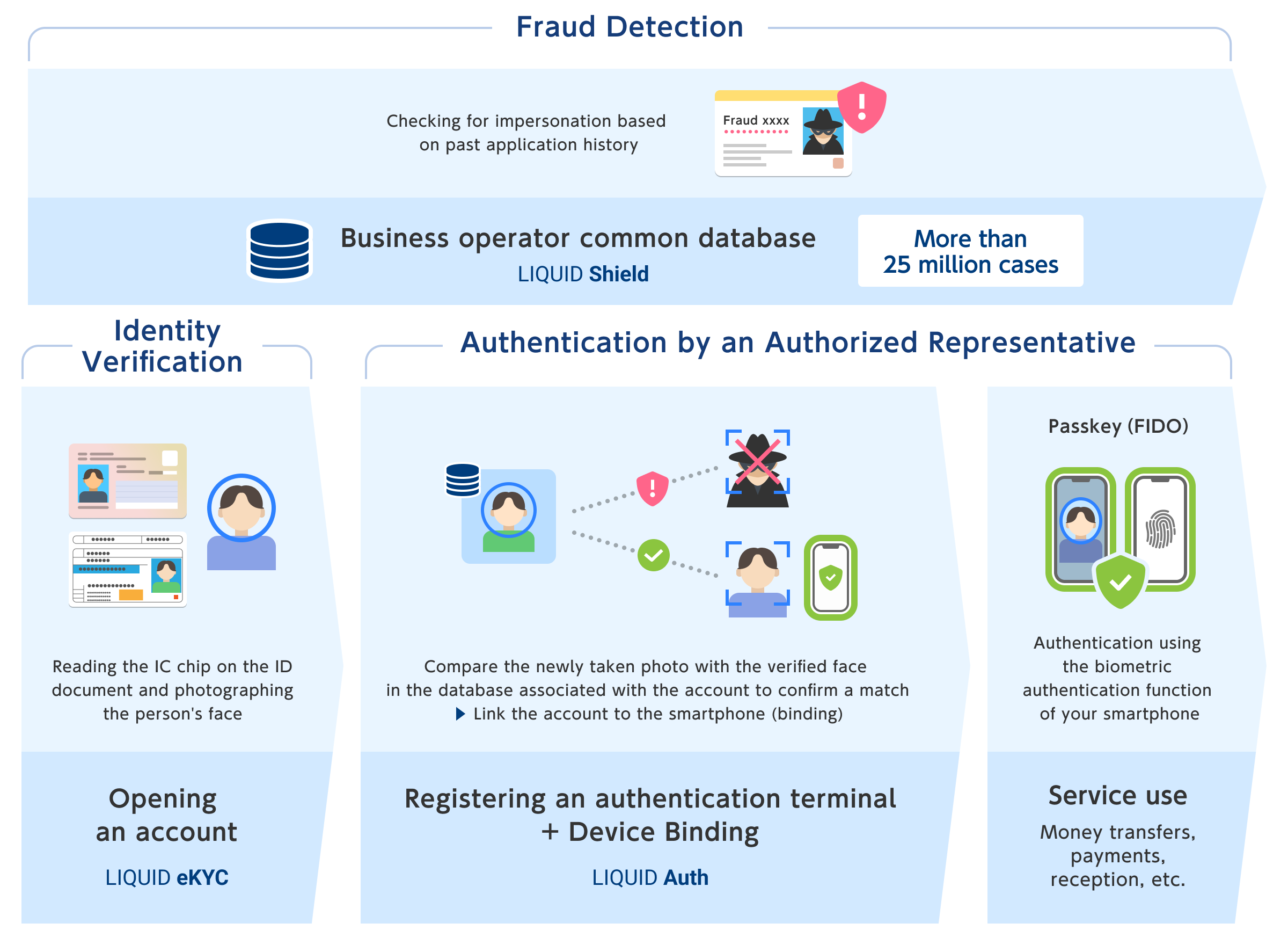

In addition to strict identity verification, the system also uses facial recognition to confirm the identity of the account holder and the actual user, and then performs binding to accurately link the user account to the user’s smartphone, preventing spoofing. Even if an ID, password or one-time password is stolen through phishing or other fraudulent methods, the system prevents the fraudster from conducting transactions. Furthermore, the standard process for verifying identity through the Public Certification for Individuals (JPKI) does not include capturing a photo of the person’s face. The “LIQUID eKYC” system includes a “JPKI+ (facial appearance) ” function, which captures a photo of the person’s face during identity verification using JPKI. This enables the system to confirm user identity through facial recognition during service use, providing fraud prevention through binding.

( About the “JPKI+ (Appearance) ” function )

・Continuous customer management using IC chips and facial recognition

After identity verification through public personal authentication, the system obtains the basic four personal information items (address, name, date of birth, and gender) from the national agency (J-LIS) with the individual’s consent. It then continuously checks the current status and updates the basic information. Combined with facial recognition, the system also ensures that accounts have not been fraudulently transferred to another person after being opened by the original user.

・Countermeasures against Impersonation (deepfakes) using generative AI

ELEMENTS has already commercialized and implemented generative AI technologies, such as its image-generation AI tool “SugeKae”, which natural-looking product images for e-commerce sites. These technologies, along with its expertise in image recognition, represent a significant technical strength across the group. Leveraging this expertise, ELEMENTS analyzes recent trends in fraudulent techniques using generative AI and provide functionality to detect all forms of digital impersonation attack, including deepfakes, free of charge to all businesses implementing its solutions.

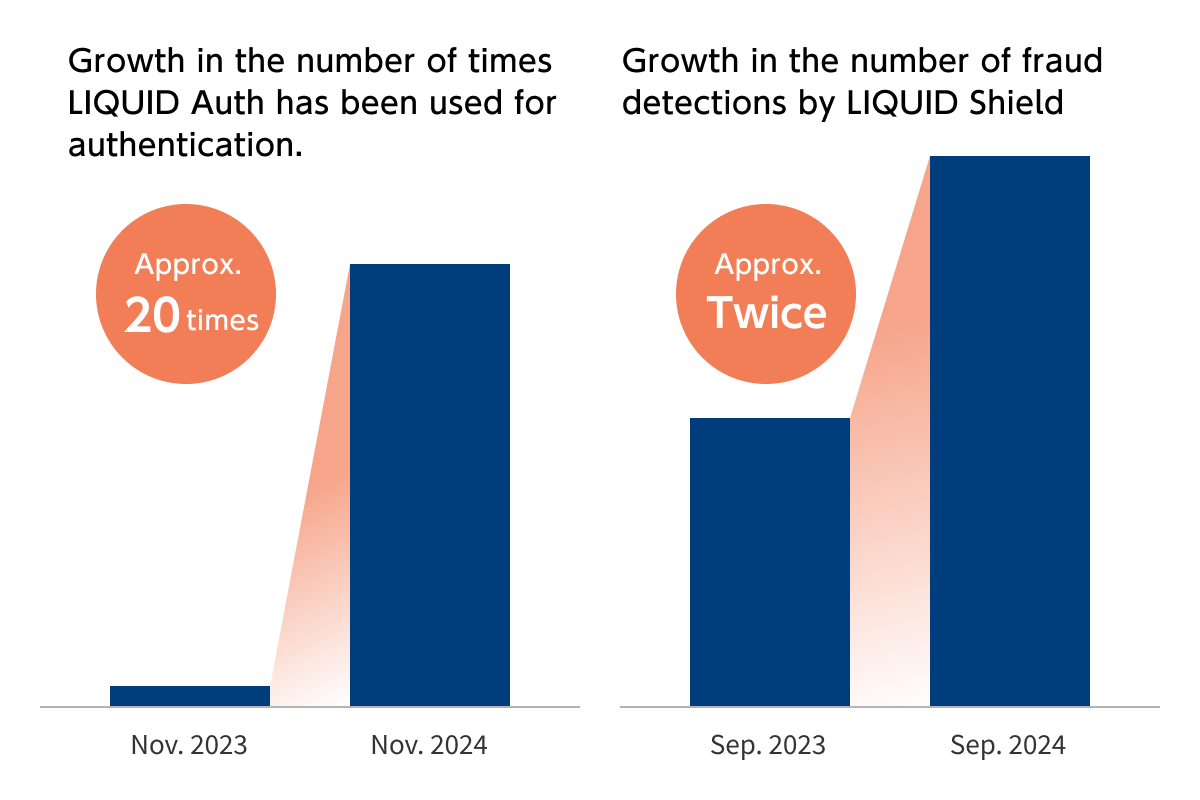

2. Approximately 20 times more authentications and twice the fraud detection across industries

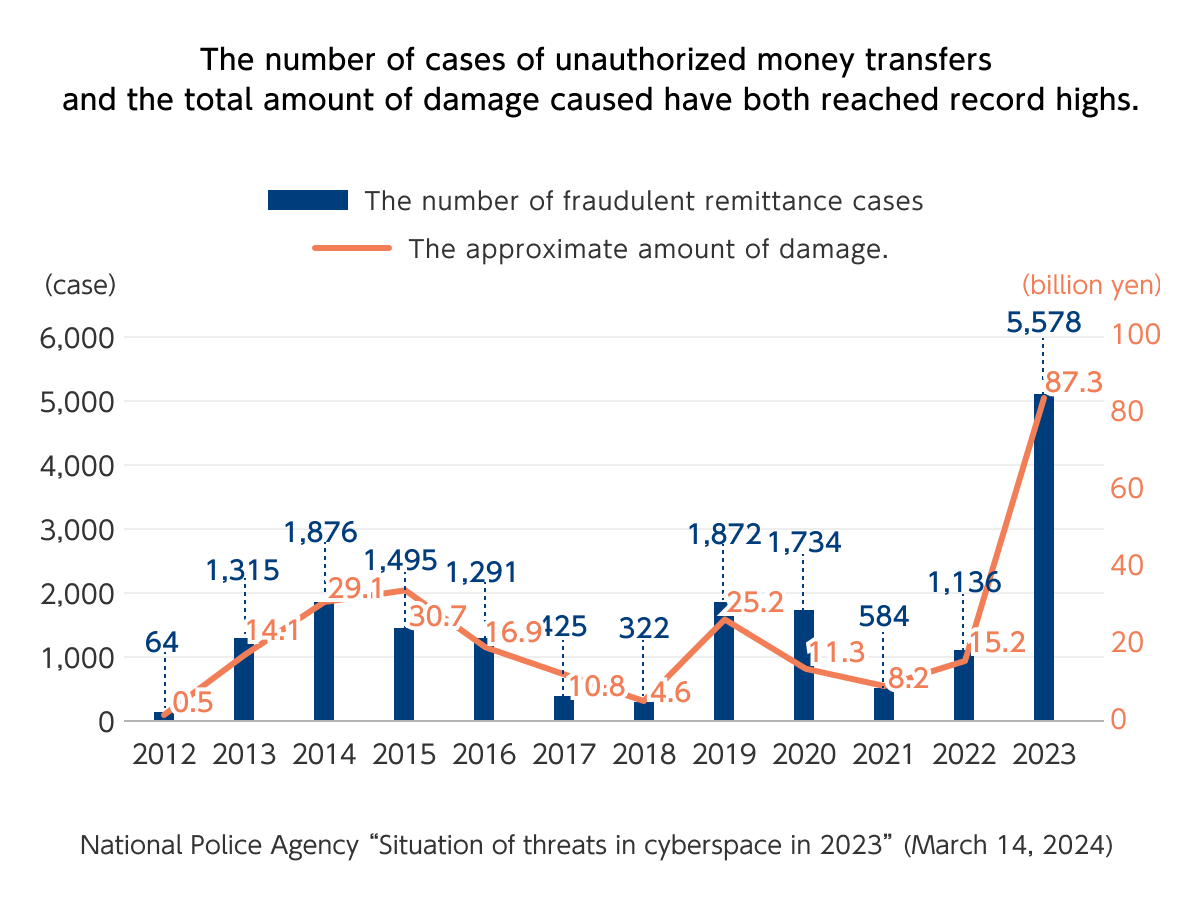

The number of fraudulent transfers related to internet banking, likely caused by phishing, reached a record high of 5,578 cases*4, with damages totaling approximately 8.73 billion yen. This underscores the urgent need for fraud prevention measures across society. At Liquid, the monthly authentication count for its user authentication service, “LIQUID Auth,” which verifies the absence of impersonation during service use, has increased approximately 20-fold year-on-year. Additionally, the monthly fraud detection count for “LIQUID Shield,” an industry-wide fraud detection service leveraging a shared database among businesses, has doubled year-on-year, reflecting a growing demand for fraud prevention solutions.

*4 National Police Agency ‘Situation of threats in cyberspace in 2023’ (March 14, 2024)

Passkey (FIDO), which allow logins without passwords and are expected to gain adoption as a next-generation authentication technology, requires accurate binding between user accounts and the user’s smartphone used for transactions during initial setup or device changes. To address potential impersonation fraud that could occur with passkey alone, Liquid integrates identity verification (ID checks), user authentication, and cross-industry fraud detection, ensuring proper binding and robust fraud prevention. We will continue to develop comprehensive anti-fraud solutions.

( Preventing fraudulent account creation and unauthorized use by seamlessly performing identity verification, user authentication, and fraud detection in an integrated process )

■About ELEMENTS, Inc.

Address:3-8-3 Nihonbashi Honcho, Chuo-ku, Tokyo

Representatives:Representative Director and Chairperson, Yasuhiro Kuda

Representative Director and President, Hiroki Hasegawa

Securities code: Tokyo Stock Exchange Growth Market 5246

Established:December 2013

Main businesses:

– Image recognition research and development

– data analysis fundamentals research and development

– Food, shelter and clothing identity verification solutions planning, development and

manufacturing

– GPU cloud service, GPU data center management

Web site: https://elementsinc.jp/global/

■About Liquid, Inc.

Address:3-8-3 Nihonbashi Honcho, Chuo-ku, Tokyo

Representative:Representative Director, Hiroki Hasegawa

Established:December 2018

Main businesses:Biometrics, image and big data analysis related to biometrics (LIQUID eKYC, LIQUID Shield, LIQUID Auth, etc.)

Web site: https://liquidinc.asia/global/

■About Sumitomo Mitsui Financial Group,Inc.

Address:1-1-2 Marunouchi, Chiyoda-ku, Tokyo

Representative:Group CEO,Toru Nakashima

Established:December 2002

Main businesses:Banking

Web site: https://www.smfg.co.jp/english/

■About Polarify, Inc.

Address:1-18-12 Nishishinnbashi, Minato-ku, Tokyo

Representative:Representative Director, Tomohiro Wada

Established:May 2017

Shareholders: Sumitomo Mitsui Financial Group,Inc., NTT DATA JAPAN Corporation, Daon, Inc.

Main businesses:Authentication service using biometric information

Web site: https://www.polarify.co.jp/

※The company names and product/service names listed in this press release are the registered trademarks or trademarks of their respective companies.

For further information, please contact

Public Relations: [email protected]